Target 353 billion! Global power battery giant releases latest strategy

On October 7, LG New Energy, the world's third-largest power battery maker, released its latest medium- and long-term strategy: to expand its business from battery manufacturing to energy cycle business and become a true total solution provider.

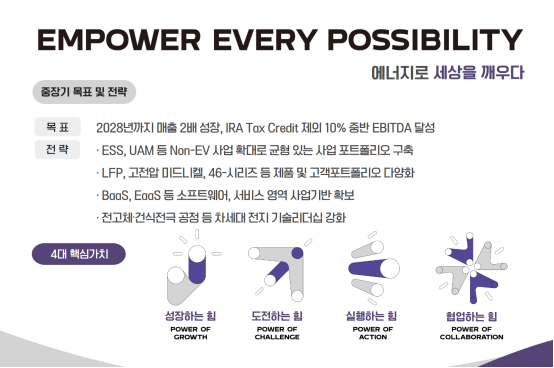

Based on this vision, LG New Energy aims to more than double its sales by 2028 compared to 2023. 2023 sales for LG New Energy are 33.75 trillion won (currently about 176.513 billion yuan), and on this basis, its sales target for 2028 is 353.025 billion yuan.

Wikipedia Lithium notes that at the end of July, LG New Energy delivered the worst second-quarter earnings report in its history (a loss of about 24 billion won), and as a result, it expects the company's revenues in 2024 to decline by more than 20% compared with 2023. In this regard, LG New Energy has a “tough battle” ahead of it in the next five years, which is the key reason for its transformation and business expansion.

In its latest medium- and long-term strategy, LG New Energy has already announced its response:

Expanding non-electric vehicle businesses such as energy storage systems (ESS) and urban air transportation (UAM) to build a balanced business portfolio;

2, Diversify product and customer structure, including lithium iron phosphate, lithium manganese iron phosphate, high-voltage medium nickel, and 46 series;

3. Expanding various service businesses such as battery rental, leasing and recycling by establishing a BaaS (Battery as a Service) ecosystem, and planning to increase the proportion of EaaS (Energy as a Service) business;

4. Strengthening its leadership in next-generation battery technologies, including all-solid-state batteries and dry-electrode processes.

In a nutshell, it means that over the next five years, LG New Energy will vigorously diversify its businesses to reduce the impact of the slowdown in the electric vehicle market and to more than double its sales growth.

To this end, LG New Energy has formulated specific medium- and long-term plans for its core business units such as automotive batteries, small batteries, and ESS batteries, and has made North America and Europe a strategic center of gravity, especially in the North American market. Behind this, the IRA Act, which has been implemented for two years, has been instrumental. 2023, LG New Energy received a total of 3.73 billion yuan in IRA subsidies, and in the first quarter of this year, it received 1 billion yuan in subsidies.

In terms of the overall medium- to long-term strategy, one of the focuses is to create differentiated advantages in materials, processes and products for batteries.

LG New Energy plans to improve its market competitiveness through high-voltage medium-nickel clad products, lithium iron phosphate products with dry electrode process, etc. in 2028, and plans to expand its 46 series to automakers.

At the same time, LG New Energy plans to produce products without lithium negative electrodes and “graphite-based” all-solid-state products, and to accelerate the mass production of “bipolar” semisolid-state batteries, low-cost, high-power batteries utilizing sulfur and sodium, and lightweight aviation batteries utilizing lithium. Batteries.

One of the pillars of all this is the dry electrode technology that LG New Energy is proud of. In July of this year, reports showed that LG New Energy called dry-coating technology a “game-changing” battery manufacturing technology, opening the way for the company to strengthen its competitiveness.

Meanwhile, LG New Energy plans to complete a demonstration line for the dry-coating process in the fourth quarter and begin full-scale production in 2028. This is the first time that LG New Energy has made public the commercialization timeline for the dry coating technology, and Kim Je-Young, LG New Energy's chief technology officer, estimates that the dry process can reduce battery manufacturing costs by 17 to 30 percent.

In addition, LG New Energy plans to begin mass production of ESS batteries in the U.S. in 2025 and achieve the No. 1 market share of ESS batteries in the U.S. and the top three in ESS system integration (SI) globally by 2028, realizing a five-fold increase in sales. In its second-quarter earnings report, LG New Energy made it clear that it plans to increase the start-up rate of each production site by converting existing EV production lines to ESS lines.

The latest data from South Korean research organization SNE Research shows that in the global power battery installed capacity ranked Top 10 from January to August this year, LG New Energy continued to hold the third place with 61.8GWh installed capacity and 12.1% market share, but its 2.5% year-on-year growth rate was much lower than the top two companies, Ningde Times and BYD, which both had year-on-year growth rates higher than 25%.

简体中文

简体中文 Russian

Russian French

French German

German Japanese

Japanese Korean

Korean Arabic

Arabic Spanish

Spanish